I first encountered Digit a couple of months ago when one of my daughters asked me to look at it as a way for her to slowly but steadily increase her savings account. As it stands she’s a pretty good saver all on her own, but the idea of an app that would monitor her bank account, watch for spending patterns, and find savings where she didn’t see them seemed like a great idea to her. So, I signed myself up to see how it works. There’s a lot of value in this app, but at present it lacks refinement and the kind of granular control you really want in an app that’s trying to save you money.

The idea behind Digit is pretty simple and it’s similar to the way you save pocket change in a jar, only with more intelligence. Digit is designed to link to one of your bank accounts, watch it for a little bit of time to learn your spending and deposit patterns, and then begin transferring money from your attached account to a private FDIC insured Digit account. And, like the pocket change you drop in a jar at the end of the day, it should make the saving almost unnoticeable.

Jeffery Battersby/IDG

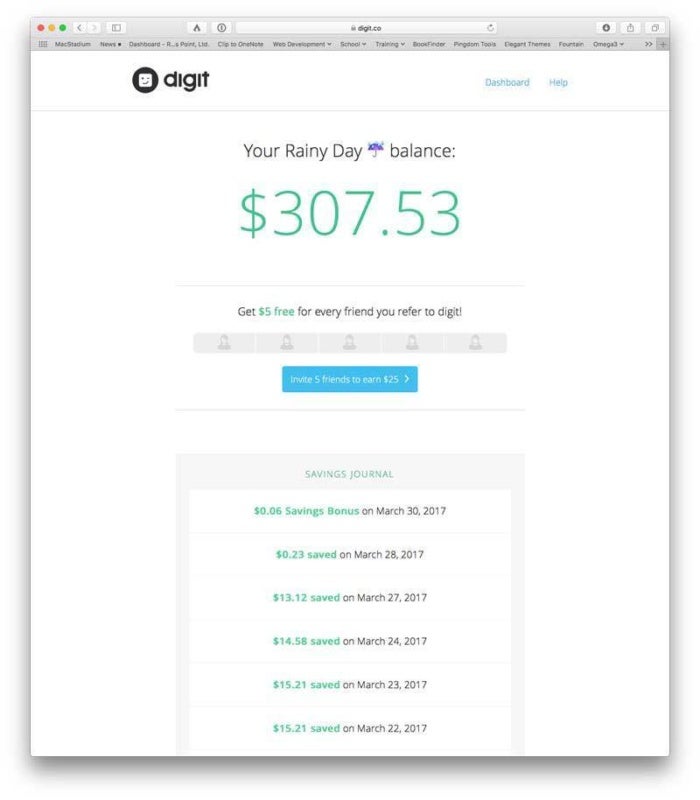

Jeffery Battersby/IDGAfter creating a Digit account you need to link an existing bank account for the app to start watching. Digit connects to a very limited but growing number of banks. I have three different banks I do business with, but Digit only let me connect to my Wells Fargo account. None of the other accounts were available, even though they’re large east coast institutions. Information on what banks Digit supports is non-existent on their website, but you can contact them directly via Twitter or email them at help@digit.co and they’ll let you know whether or not your bank is supported.

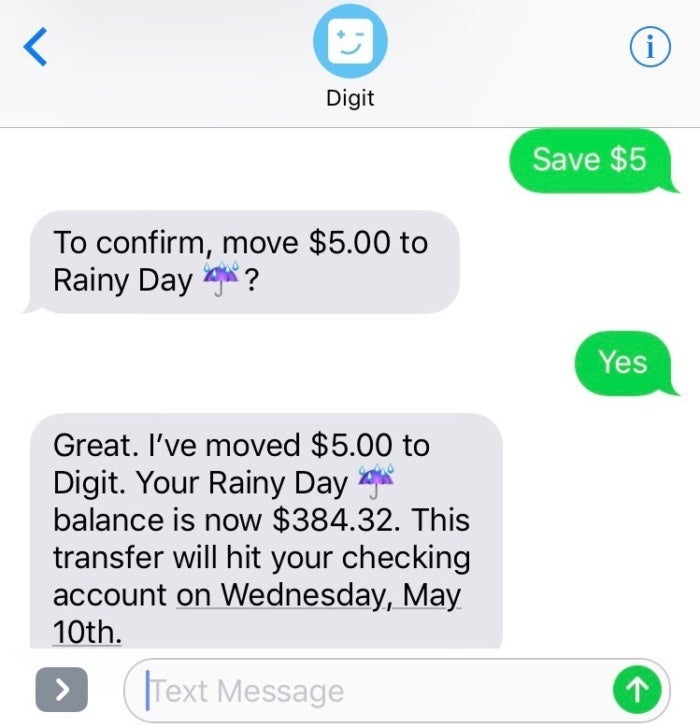

You interact with Digit with the Messages-like Digit app or with Messages itself using several specific text-based commands. Savings to see how much you’ve saved, Recent for recent transactions, Pause to temporarily pause automatically saving money, Save and a dollar amount to put a specific amount of money into your account.

Jeffery Battersby/IDG

Jeffery Battersby/IDGDigit’s money saving algorithm is curious. I usually keep between $400 and $1,400 dollars in the account I linked to Digit. When I first started using the app it literally pulled pennies from my account. 17 cents, 22 cents, and 13 cents for the first three transactions. To boost my savings a bit I texted Save to Digit with a dollar amount and it added that much more to my Digit savings account.

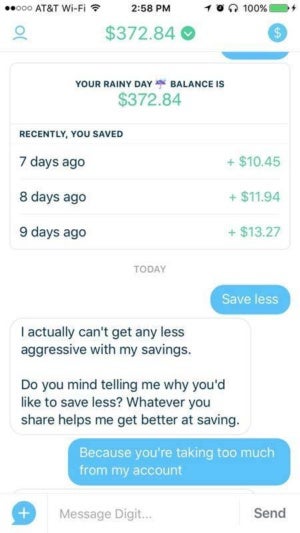

About two months in, Digit began to save whole dollar amounts, then Digit began making regular withdrawals of between $10 and $20 two to three times a week, draining my linked checking account balance to under $100 and $50-plus dollars a week was more aggressive than I was comfortable with.

Looking at Digit’s Twitter feed it’s clear this is a common issue. Several people posted screenshots with similar complaints. So mine was not an isolated experience. Digit does offer features to help mitigate such a heavy drain on your bank account, including a guarantee not to overdraw your account—a feature you can only use twice. But when I texted Digit to Save less, I got a reply stating this wasn’t possible. The service has other similar limitations. Ask it to save $5 a week or $50 a month and you’ll find that isn’t possible either. But these are options that would make the app more valuable.

Jeffery Battersby/IDG

Jeffery Battersby/IDGDigit was free when I first began looking at the app. Mid-April the company announced they would begin charging $3 a month beginning at the end of July. I’m happy to pay for online services, particularly those services that have access to personal and financial information. Especially if that means my private information will be kept private. At present, according to Digit’s privacy policy, they use your information “…to offer our products and services and products and services of third parties that we think you might find of interest…”. Based on their current policy, you are what’s being marketed. It’s unclear whether that policy will change once Digit is converted to a paid service, but the current policy is enough for me to say no thanks.

Bottom line

I like Digit, but it’s not yet what I want in an automatic savings app. More control over my personal data, more control over how money is being saved, and access to more bank accounts will go a long way towards making Digit a service I’d want to use.